Netflix Will End Quarterly Subscriber Reports in Favor of Engagement and Revenue Metrics

Netflix announced a significant change in its reporting strategy during its first-quarter earnings call for 2024. Starting in 2025, the company will discontinue the quarterly reporting of its subscriber numbers. This decision comes despite Netflix adding 9.33 million new paid subscribers in the first quarter alone, bringing its total to 269.60 million.

Greg Peters, Netflix co-CEO, explained that the traditional metric of multiplying the number of members by the monthly price needs to accurately reflect the current state of their business. He highlighted that Netflix's business model has evolved to include new features like advertising and the 'extra member' feature, which are not directly tied to subscriber numbers. Furthermore, the company has adjusted its pricing and plans to include multiple tiers and price points across various countries. Peters stated that this change focuses on what the company views as the key metrics that truly matter to the business.

Netflix plans to provide annual revenue guidance and operating income margin. For 2024, Netflix expects revenue growth of 13% to 15% and an operating margin of 25%, an increase from its previous forecast of 24%. Peters also mentioned that while Netflix will no longer regularly report subscriber numbers, it will announce significant milestones in subscriber growth when they occur.

Co-CEO Ted Sarandos emphasized that Netflix is now focusing on engagement as the primary indicator of member satisfaction, which he believes is a leading indicator for retention and acquisition over time. According to Sarandos, higher engagement leads to increased revenue and profit, which are the company's ultimate goals.

The Take

Netflix's decision to stop disclosing quarterly subscriber and Average Revenue per Member (ARM) numbers marks a strategic pivot from a high-growth, low-profit model towards a more mature phase of slower growth but higher profitability. Analysts view this shift as a natural progression for the company as it balances global content creation costs and seeks to boost profitability.

The market's reaction was initially negative, with Netflix shares dropping 12% following the announcement. Investors are concerned that the lack of transparency in subscriber numbers might indicate a slowdown in growth. This reaction mirrored the market's response to Apple in 2018 when it stopped disclosing unit sales for iPhones and other products, suggesting that focusing on unit sales was becoming less relevant to the company's strategy.

This change in reporting is consistent with trends observed in other tech companies like Meta and Apple, which have reduced disclosures as their growth has stabilized. However, it is less common in the media and entertainment sector, where companies typically break out revenues according to distribution channels. Netflix's approach will likely lead to discussions about the implications of reporting a mix of subscription and advertising revenues without detailed visibility into each segment.

Netflix's strategic decision to avoid frequent subscriber updates is a testament to its forward-thinking approach. By shifting focus towards a broader narrative of profitability and cash flow, the company is emphasizing the effectiveness of its evolving business model over just growth metrics. This move reflects Netflix's confidence in its diversified revenue streams and the lessening importance of subscriber counts as a standalone metric for business health in the streaming industry. This keeps the users informed and confident in the company's direction.

Source: 43Twenty

Digital TV Research: Global AVOD Revenue to Reach $68 Billion by 2029, Led by the U.S.

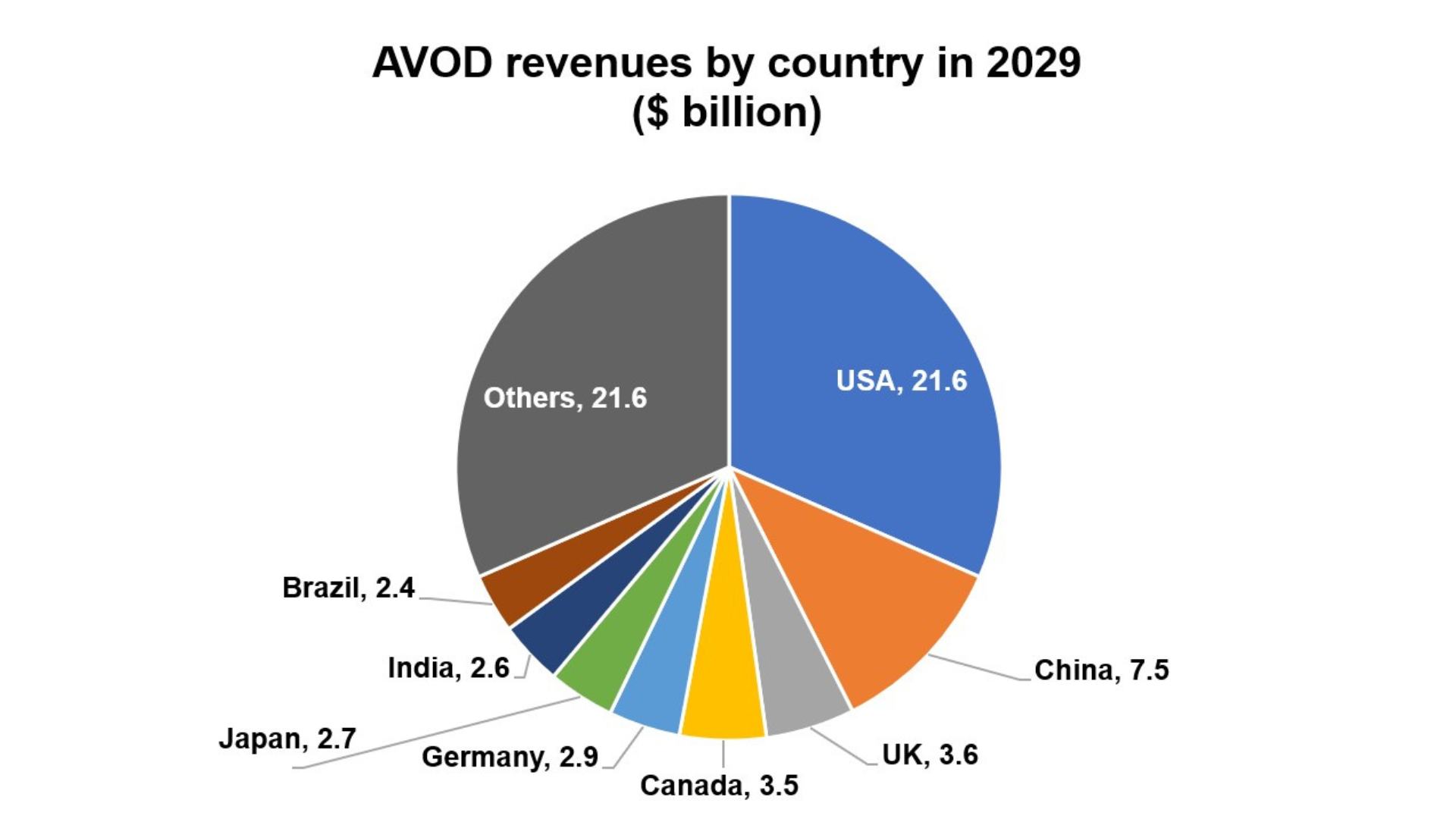

Global revenue for ad-supported VOD TV series and movies will reach $68 billion by 2029, up by $30 billion from $39 billion in 2023, according to new data from Digital TV Research. The United States, which bowed the AVOD market with Crackle, Shout! Factory TV, The Roku Channel, Pluto TV and Tubi, among others, will contribute $21.6 billion (32%) to the 2029 AVOD total, down from 40% in 2023 — underscoring the reality that other countries’ AVOD revenue is growing.

That said, the U.S. AVOD revenue tally is almost three times larger than runner-up China with $7.5 billion.

“The U.S. will increase its AVOD revenue by $6 billion between 2023 and 2029, with China adding about half that amount (having recovered from its present ad recession),” Simon Murray, principal analyst at Digital TV Research, said in a statement. “Australia, Brazil, Canada, France, Germany, India, Japan and the U.K. will all add more than $1 billion.”

Source: Media Play News

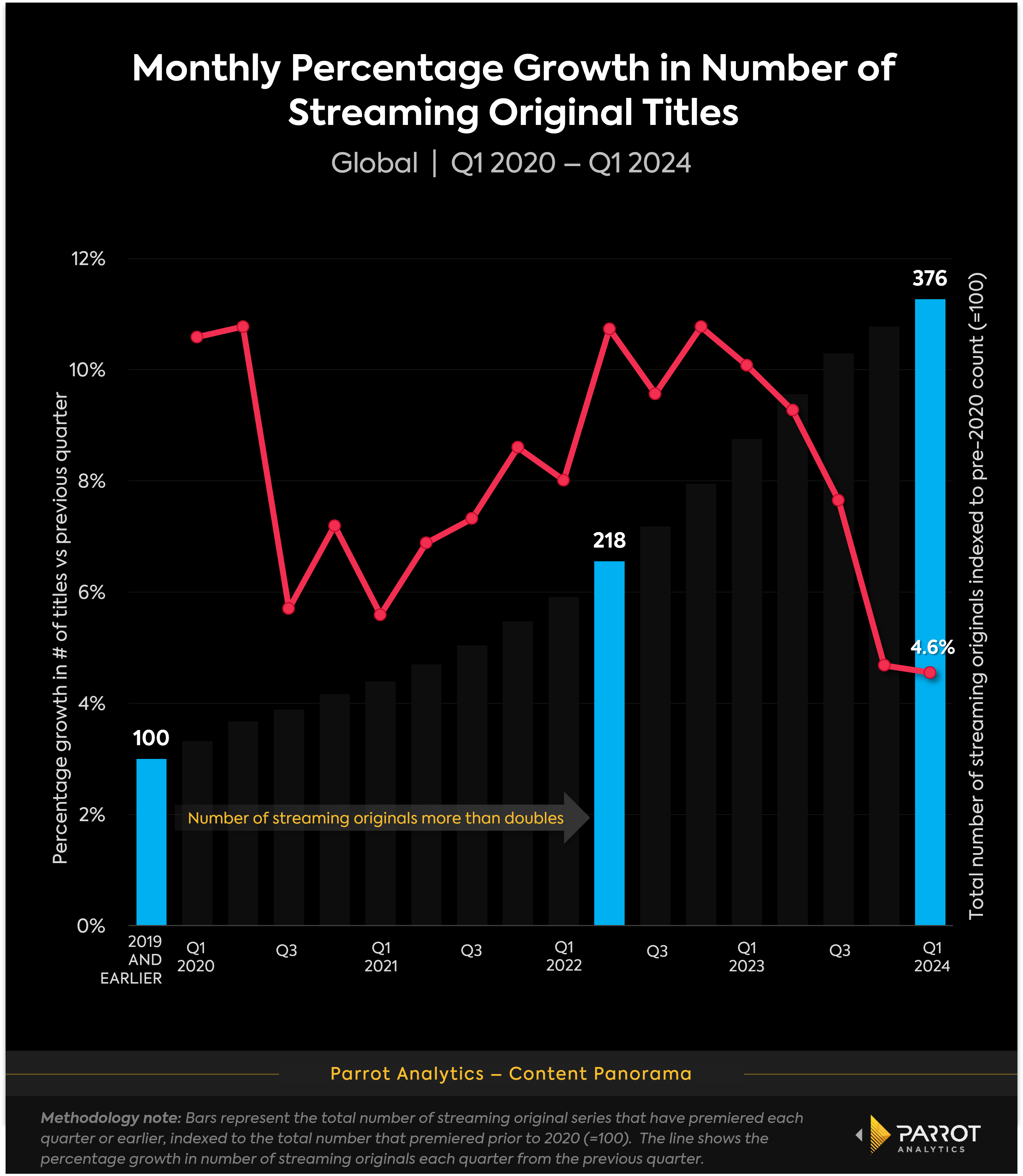

Understand the streaming landscape in this weekly data snapshot series provided by Parrot Analytics. This week's chart shows how the pace of new streaming content has slowed down over the past year.

Key Findings Include

- A supply side analysis of the global streaming landscape with Parrot Analytics’ Content Panorama reveals an industry that has pumped the brakes on the output of new content in recent quarters.

- The pace of new streaming originals premiering has slowed each quarter since the end of 2023, as content production was impacted by strikes and platforms reevaluated the financial prudence of rapid growth in new content.

- Q1 2024 saw the rate of new series premiering stabilize at a level on par with the last quarter of 2023. We will need more data to know for sure but this could be a turning point for the amount of new streaming content.

Advertisement

PIONEERS IN STREAMING VIDEO. EXPERTS IN SEO CONTENT MARKETING.

- Strategy Consulting - We consult across the following areas: business strategy, business development, product marketing, SEO, PPC, UX strategy, and vendor selection.

- Content Marketing - We create content that boosts visibility and establishes thought leadership, including blog posts, web copy, gated assets, newsletters, infographics, webinars, etc.

- SEO - We ensure that our client’s sites and content rank highly on search engine results pages (SERPs) and convert those searchers into leads and customers.

- PPC - We excel at dynamic paid ad campaigns on LinkedIn and Google, delivering targeted precision, maximum ROI,and tangible results.

Discover more here or send us an email to schedule a meeting.

In Case You Missed It

Popularity of NFL as a Streaming Product Shows Why Streaming-Exclusive Games Are Increasing. The Streamable

Sony Is in Talks With Apollo on a Joint Paramount Bid. Bloomberg

YouTube TV Unlocks Access to Over 100 Apps & Apps From Popular Networks. Cord Cutter News

SkyShowtime and Paramount Advertising International announce exclusive ad sales partnership. Broadband TV News

NBA Set to Emerge from Exclusive Negotiating Windows with ESPN, TNT; What Will its New Deal Look Like?. The Streamable

Netflix Pay: Greg Peters Hit $40M in First Year as Co-CEO, Ted Sarandos Saw $49.8M In 2023. Hollywood Reporter

Max Adds a DVR For Live Sporting Events. Cord Cutter News

Apple might be the streaming home of soccer’s next big tournament. The Verge

Disney+ Acquires Live Soccer Rights in Europe; Is it a Preview of What Viewers Can Expect in the US?. The Streamable

Intel will use AI to power talent identification tech and 8K streaming at Paris 2024 Olympics. Sports Pro Media

Fubo Gets a Date in Court In Its Efforts to Stop Disney, FOX, & Warner Bros Discovery From Launching a New Sports Streaming Service. Cord Cutter News