Paramount at a Crossroads: Peacock Merger, Sony's Interest, and Skydance Negotiation Challenges Amidst Leadership Transition

Paramount Global continues to be a focal point in the media industry, currently negotiating a potential merger with Peacock's streaming service. This move is a strategic attempt to bolster their competitive stance in a fiercely contested market. Despite a combined subscriber base of 100 million between Paramount+ and Peacock, they trail behind Netflix's 270 million and Disney+'s 111 million subscribers.

Recently, Paramount announced the departure of its long-standing CEO, Bob Bakish, amidst rumors of discord over strategic directions, particularly concerning the merger with Skydance Media. Following his exit, the merger discussions have waned, with Paramount opting not to extend the exclusive negotiation period with Skydance. Concurrently, Shari Redstone, the controlling shareholder, prefers the $26 billion offer from Sony Pictures and Apollo Global Management.

In response to the leadership vacuum, Paramount has instituted a three-member interim executive committee: George Cheeks from CBS, Brian Robbins of Paramount Pictures, and Chris McCarthy, who oversees Showtime/MTV Entertainment Studios and Paramount Media Networks. Amidst these changes, Paramount's stock plummeted by 7% to $12.89. The board has appointed Chris McCarthy as the "interim principal executive officer" to manage the regulatory compliance required by the Securities Exchange Commission, with the interim team functioning as co-CEOs.

The Take

Paramount Global's recent activities—from exploring sales to executive reshuffling—underscore the company's tumultuous period. The company faces significant financial instability with $14.6 billion in debt and stalled negotiations, notably with Skydance Media. Last month, despite a preliminary agreement with Skydance, Paramount declined to prolong their exclusive negotiation period. This decision reopened the floor to other potential partners, including Sony and Apollo Global Management, who extended a $26 billion all-cash bid. Despite a recent $3 billion offer from Skydance aimed at stock buybacks and debt reduction, the deal remains unconcluded, with Skydance hesitant to raise their bid further.

The proposed merger with Peacock seeks to create a more substantial presence in the streaming arena, potentially narrowing the subscriber gap with industry leaders. Yet, ownership and control are pivotal, with Comcast only considering a merger if it retains control over the combined entity, revealing ongoing negotiation challenges.

Moreover, the dialogue around Paramount's merger with Skydance continues to garner attention, especially with endorsements from Hollywood heavyweights like James Cameron and Ari Emanuel, positioning Skydance as a viable contender despite the faltered negotiations.

Paramount's engagement in these complex discussions highlights the intricate nature of media mergers and acquisitions, demonstrating the company's pressing need to stabilize its financial situation and secure a partnership conducive to growth and competitive viability. The evolving scenarios with Peacock, Skydance, and other suitors spotlight the dynamic and challenging landscape of the media and entertainment industry.

Source: 43Twenty

Amount of Streaming Customers Using Ad-Supported Plans Jumps 10% After Prime Video’s Ad Rollout

By all accounts, Prime Video handed advertisers a significant gift when the streamer rolled out its ad plan at the end of January. Amazon followed a unique strategy with the launch of its ad-supported tier; instead of creating a lower-cost option with ads for customers to choose, the streamer simply moved all current customers to the ad tier without changing the price, requiring them to pay more for an ad-free option. New data from Hub Research is highlighting how many Prime Video subscribers simply accepted the move, and how that has impacted the state of ad-supported streaming as a whole.

Key Details:

- In total, 85% of Prime Video customers are now on its ads plan, the highest proportion of any service.

- After Prime Video’s ad launch, the total number of streaming customers who use only ad-supported plans jumped 10 percentage points industry-wide.

Having the additional revenue from ad-supported customers could help Amazon pay for its new package of NBA rights.

Source: The Streamable

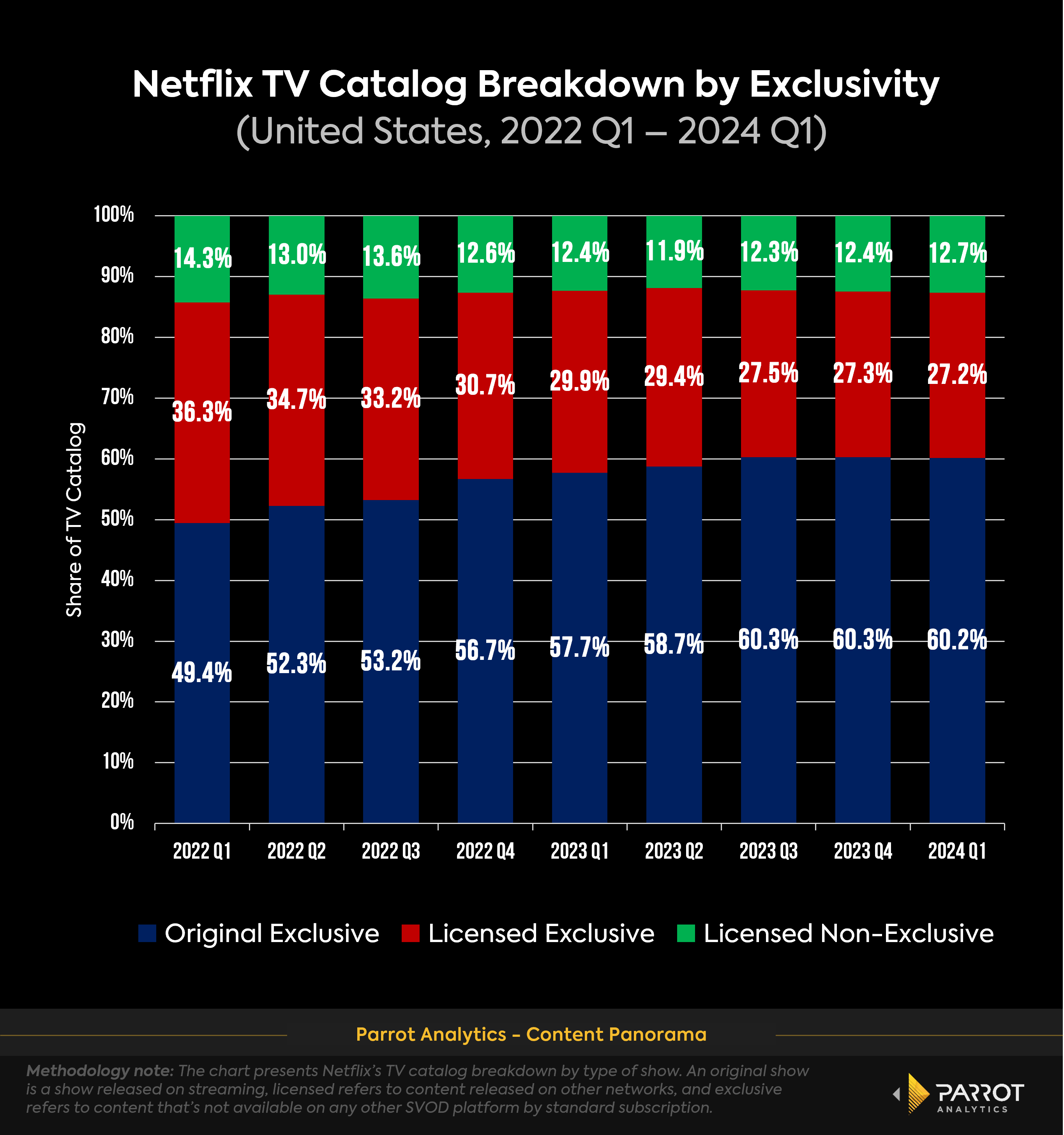

Understand the streaming landscape in this weekly data snapshot series provided by Parrot Analytics. Exclusive content is an important tool for platforms when it comes to reducing churn. With Parrot Analytics Content Panorama we can analyze how the exclusivity of platform catalogs has shifted over time.

Key Findings Include

- The share of series on Netflix in the US that are not exclusive to the platform is far smaller than the share of titles on the platform that are original series or exclusively licensed.

- While the total share of series on Netflix that are exclusive hasn’t shifted much over the past few years, (staying between 85 - 90% of the catalog), the growth in Netflix originals is apparent. Originals made up a growing share of exclusive series on Netflix while the share of exclusively licensed titles has continued to shrink.

- There has been a slight uptick in the share of licensed non-exclusive shows on Netflix over the past three quarters, perhaps signaling more openness from the platform to non-exclusive content.

Advertisement

PIONEERS IN STREAMING VIDEO. EXPERTS IN SEO CONTENT MARKETING.

- Strategy Consulting - We consult across the following areas: business strategy, business development, product marketing, SEO, PPC, UX strategy, and vendor selection.

- Content Marketing - We create content that boosts visibility and establishes thought leadership, including blog posts, web copy, gated assets, newsletters, infographics, webinars, etc.

- SEO - We ensure that our client’s sites and content rank highly on search engine results pages (SERPs) and convert those searchers into leads and customers.

- PPC - We excel at dynamic paid ad campaigns on LinkedIn and Google, delivering targeted precision, maximum ROI,and tangible results.

Discover more here or send us an email to schedule a meeting.

In Case You Missed It

Google TV’s ‘Magic Button’ debits — but not on a Chromecast. The Verge

YouTube Is Rolling Out An AI Tool That Will Skip Over Boring Parts of Videos. Cord Cutter News

Disney, Fox, Warner Bros Discovery Push Back on Sports Streaming Plan Concerns. MSN

New Details Emerge on Roku’s Potential Deal for MLB Games; Viewership Data Shows League is in a Bind. The Streamable

Warren Buffett Has Sold His Paramount Stock: “We Sold it All, and We Lost Quite a Bit of Money”. Hollywood Reporter

Video Streaming Subscriptions Reach Record Levels in Southeast Asia, Representing Rebound – Report. Variety

Fubo Q1 exceeds guidance. Advanced Television

NFL reportedly in talks with Disney about stake in ESPN. Digital TV Europe

MLB and Roku ‘in advanced talks’ over Sunday morning games. Sports Pro Media

Disney Makes Signing into Disney+, Hulu, and ESPN+ Easier As It Gets Ready to Launch an ESPN Stand-Alone Streaming Service. Cord Cutter News